How to Apply for Equifax Credit Score

Loading your search...

An Equifax credit score is a three-digit number that ranges from 300 to 900. It summarises an individual’s credit behaviour and the extent they are a financial risk. A higher score means a better credit history, while a lower score means the person has a tendency for late payment or high balances on credit accounts. Financial institutions will use the Equifax score to evaluate borrowing risks.

Cost of Equifax Credit Score/ Credit Report

There are 3 different Equifax’s Credit Report Subscription Plans. You can choose a plan that suits your needs and enjoy access to your credit information:

Price | Plan Type | Subscription | Benefits |

Rs. 100 | One-Time | Single Report | Download one comprehensive credit report |

Rs. 450 | Quarterly | 3 Months | Credit report with score and score simulation |

Rs. 900 | Yearly | 12 Months | Credit report with score and score simulation for the full year |

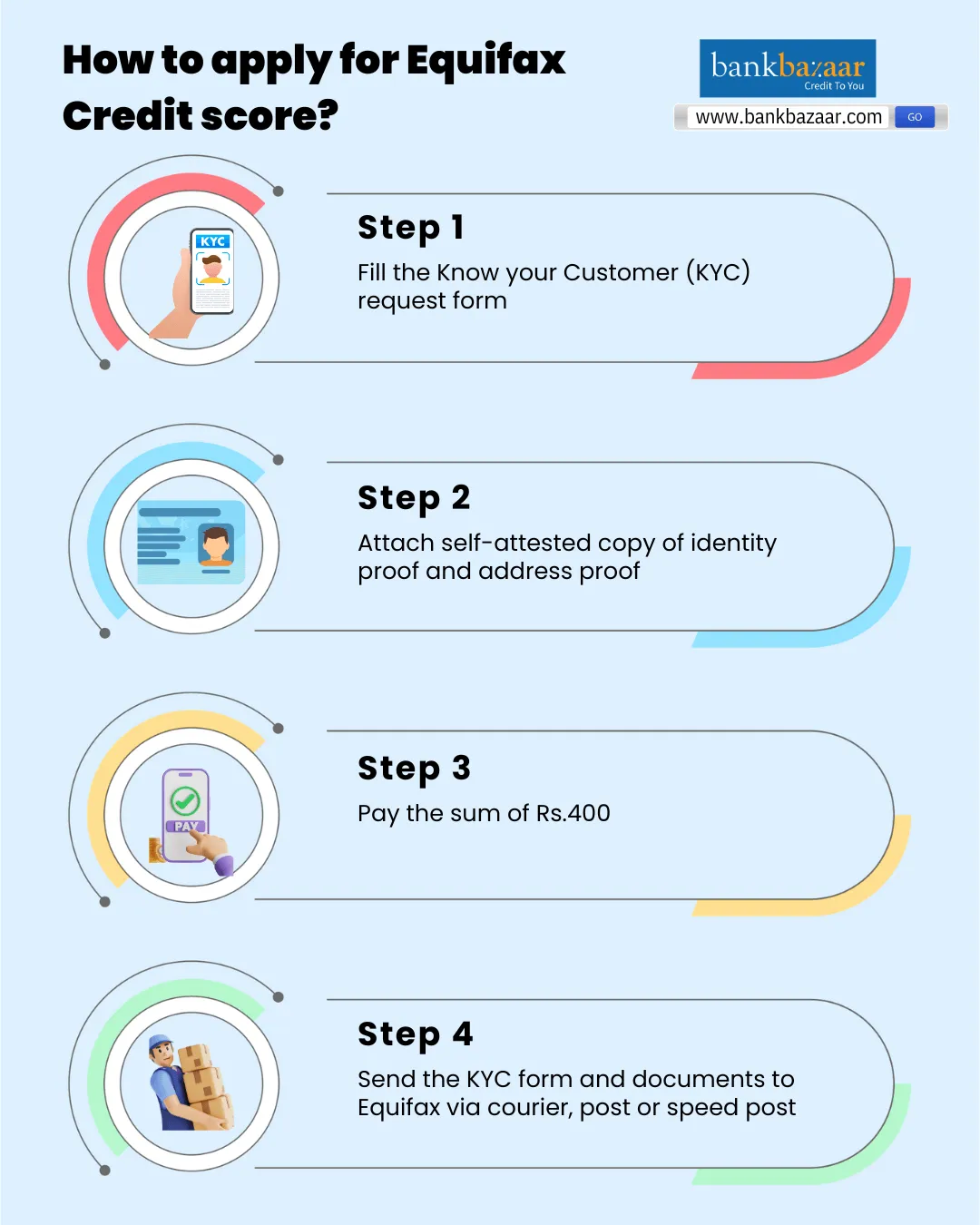

How to Apply for Equifax Credit score?

An individual will have to take the credit report if he/she wants to receive the credit score as well. In order to get the credit score, a person has to:

- Step 1: Set Up a Profile

Register with your email address and mobile number, then set up your profile, which includes creating a password.

- Step 2: Verify Your Identity

You will receive an OTP (One Time Password) to verify your information and to ensure the authenticity of the request.

- Step 3: Review Your Information

Enter and verify some basic information, such as your date of birth, address, and IDs such as your PAN, Aadhaar, etc.:

- Step 4: Create Your Report

When you have logged in, select the option ‘Run your Free Report’ on your dashboard to see or download your first free credit report.

Documents to Apply for Equifax Credit score

You can submit any one of the following documents:

Self-attested identity proof copies (Any One):

- Government Photo ID cards/ Service photo identity card issued by PSU

- NREGS Job card

- Pensioner Photo card

- Kissan Photo Passbook

- Gazette notification for name change

- Bank Passbook having name and photograph

- Ration card

Address proof (anyone):

- Electricity bill

- Landline or mobile phone bill

- Credit card statement or bank statement

- Gas utility bill

- Ration card

- Driving license

- Rent agreement

Free Equifax Credit Report/ Credit Report

Individuals who are not looking forward to spending money on their Equifax Credit score can choose to contact online platforms. These platforms have joined hands with Equifax to offer free Credit Scores. This will help a large number of people to check their credit worthiness and apply for a loan or a credit card thereby saving some money.

What affects Equifax Credit Score?

There are a total of 600 different variables that affect the Equifax credit score. Here are some of the top variables:

- Past credit repayment history

- Credit usability of present

- Number of credit cards that one holds

- Number of secured loans one has

- Number of unsecured loans one has

- Demographic variables

- Income of the person

Contact Information

Here are the keyways to reach Equifax Credit Information Services, along with their operating timings and address for easy reference:

Category | Details |

Phone | 1 800-209-3247 |

Timings | Monday to Friday, 10:00 hours to 19:00 hours |

Address | Equifax Credit Information Services Pvt Ltd., 3rd floor, Building No. 9, Solitaire Corporate Park, Andheri Ghatkopar Link Road, Andheri East, Mumbai - 400093 |

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

Read More on Equifax

- Equifax Vs CIBIL Vs Experian Vs Highmark

- Enhanced Credit Information Report

- Basic Equifax Credit Information Report

- How to Maintain Healthy Credit History

- Equifax ePort

- Register with Equifax ePort

- Equifax Credit Score Vs CIBIL Credit Score

- How does Equifax verify your ID?

- Product and Services Offered by Equifax Consumer Bureau

FAQs on How to Apply for Equifax Credit Score

- What does the Equifax credit score tell you?

The Equifax credit score tells you about an individual’s ability and propensity to pay borrowed money back on time. The higher the score (closer to 900), the more likely the individual has a good payment history and effective debt repayment history, while the lower the score (closer to 300) poses higher risk factors like late payments, defaults, or excessive debt. Lenders use this score to assess whether it is safe to lend to an individual.

- What is a good Equifax credit score?

Generally, if your Equifax score is above 750-800, it is regarded as excellent, and you provide evidence to lenders that you're a good credit risk. An Equifax score between 700 and 749 is considered a good score, and a score between 650 and 699 is considered fair. Typically, below a score of 650 indicates that you may represent a high risk to lenders.

- Is it possible for my Equifax credit score to change?

Yes. Credit scores are not static; they change as your individual credit behaviour changes. If you pay your bills on time, pay any debts, or don't miss payments at any time, you are likely to see an improvement in your score. If you miss payments, use a lot of your available credit, or default on a loan; your score will likely take a hit.

- How can I check my Equifax credit score?

You can check your Equifax credit score online via the Equifax India portal. Everyone is entitled to one free credit report each year. If you would like to verify your credit report more frequently, you can obtain other credit reports through a subscription plan. If you are consistently checking your report, you will have a better understanding of your overall credit health and will also be able to take corrective action if necessary.

- How do lenders use Equifax credit scores?

Lenders view your credit score to determine your risk as a borrower. If you have a high score, lenders will be more likely to lend you money in the form of a loan or credit card at a lower interest rate. If you have a low score, you may not be able to borrow money or will be paying a high interest rate. Lenders want to be able to make objective decisions when extending credit.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.