Axis Bank Car Loan Eligibility Calculator

Axis Bank offers car loans at attractive rates for salaried individuals, self-employed persons, and non-individuals. Special schemes are available for salary account holders, priority, wealth, and private banking customers.

Updated On - 28 Feb 2026

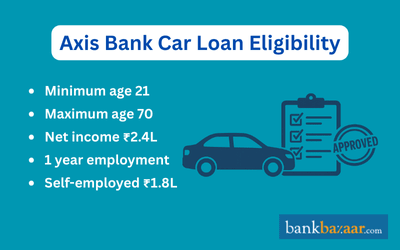

1. Salaried Individuals

- Minimum age: 21 years

- Maximum age at loan maturity: 70 years

- Minimum net income: Rs. 2.4 lakhs per annum

- Continuous employment: At least 1 year

2. Self-Employed Individuals

- Minimum age: 18 years

- Maximum age at loan maturity: 75 years

- Minimum net income: Rs. 1.8 lakhs per annum for selected models, Rs. 2 lakhs for others

- Minimum business experience: 3 years in the same line of business

3. Firms, Companies & Non-Individuals

- Minimum net income: Rs. 1.8 lakhs per annum for selected models, Rs. 2 lakhs for others

- Minimum business experience: 3 years in the same line of business

4. Special Scheme for Salary Account Holders

- Salary must be credited to an Axis Bank account for the past 3 months

- Minimum age: 21 years

- Maximum age at loan maturity: 70 years

- Minimum net annual income: Rs. 2.4 lakhs

- Continuous employment: At least 1 year

- Eligible employees:MNCs

Public or Private Limited Companies

Permanent employees in Central/State Government, Public Sector Undertakings, or reputed schools/colleges

- MNCs

- Public or Private Limited Companies

- Permanent employees in Central/State Government, Public Sector Undertakings, or reputed schools/colleges

5. Special Scheme for Priority, Wealth, and Private Banking Customers

- Minimum age: 21 years

- Maximum age at loan maturity: 70 years

- Minimum net annual income: Rs. 2.4 lakhs

- Continuous employment: At least 1 year

- Minimum average quarterly balance (AQB): Rs. 1 lakh for the last 2 completed quarters

- Minimum banking vintage: 6 months

- Loan eligibility: Up to 3 times the AQB of the last 2 quarters

Want to know Axis Bank Car Loan Interest Rates Check here

How CIBIL Scores Affect Your Axis Bank Car Loan Eligibility

CIBIL scores reflect your credit history and play a major role in determining your eligibility for loans, including car loans from Axis Bank.

What is a CIBIL Score?

- CIBIL stands for Credit Information Bureau (India) Limited.

- It tracks how you manage credit, such as loans or credit cards.

- Records include timely payments, defaults, and repayment patterns.

- A good CIBIL score shows you are a responsible borrower.

Why CIBIL Scores Matter for Car Loans

- High Score (750+): Increases chances of loan approval with minimal terms.

- Average Score: You may still get the loan, but conditions could be stricter.

- Low Score: Can delay or even reject your loan application.

Tips to Maintain a Good CIBIL Score

- Always pay EMIs and credit card bills on time.

- Avoid missing payments or defaults.

- Keep your credit utilization low.

- Regularly check your credit report for errors.

How to Increase Your Axis Bank Car Loan Eligibility

Boost your chances of getting a higher loan amount with these proven tips:

- Add a Co-BorrowerInclude your spouse or close family member. Their income counts towards the loan, increasing eligibility.

- Improve Your Credit ScoreCheck your CIBIL score and fix any discrepancies. Make timely payments to gradually raise your score.

- Clear Existing DebtsPay off outstanding loans or credit card balances. A lower debt-to-income ratio helps you qualify for a bigger loan.

- Increase Your IncomeAdd income sources like freelance work, rentals, or business earnings. Higher income can raise the maximum loan amount.

- Maintain Job StabilityLonger tenure at your current job or business reassures the bank of repayment ability.

- Limit Loan and Credit ApplicationsMultiple inquiries in a short period can reduce your credit score. Apply strategically to protect your score.

- Consider a Longer Loan TenureExtending the repayment period may allow higher eligibility. It lowers EMIs, making the loan more affordable.

Factors affecting Axis Bank Car Loan eligibility

Some of the factors that affect Axis Bank Car Loan eligibility are given below:

- Income: You will have to earn a minimum salary on a monthly basis in order to be eligible for the car loan scheme offered by Axis Bank. Higher your income, better are your chances of availing a car loan from Axis Bank.

- Market fluctuation: Fluctuation in market also determines the interest rate that will be charged on your loan amount. The rate of interest may be higher if the inflation is high, and similarly can be lower if the inflation rate is lower. Hence, always check how the market is performing before availing a car loan.

- Loan amount: The loan amount will determine the rate of interest levied. Higher the loan amount, higher will be the rate of interest.

- Repayment tenure: The repayment tenure plays a role in the lender determining the rate of interest charged on the loan amount. Higher the repayment tenure, higher will be the interest rate charged and vice versa.

- Income-to-debt ratio: The lender checks the income-to-debt ratio before deciding whether they should approve your car loan or not. The income-to-debt ratio is nothing but the ratio of your income to the debt you own. Hence, in order to avail a car loan at a lower interest rate, you must ensure that your income-to-debt ratio is low.

- Relationship with your bank: Your relationship with the lender will also determine the rate of interest levied on the loan amount. It is always recommended that the applicant avails a car loan from the bank where he/she holds a bank account. The bank finds it easier to provide loan to a person who has been a customer of the bank for a very long time. Hence, there is a very good chance that the applicant will get a car loan at a lower interest rate.

A good credit score can help you secure lower interest rates on loans and credit cards.

Car Loan Articles

- Car Prices in India

- How To Transfer a Car Loan to Another Person

- How GST Affected Car Prices in India

- Car Lease Vs Car Loan

- Car Loan Foreclosure Procedure

- Vehicle Registration

- Car Loan Document Checklist

- Bad Credit Car Loan

- Car Loan Refinancing

- Zero Downpayment Car Loan

- Commercial Car Loan

- Car Loan for Nris

- Car Loan Schemes for Women

- Car Loan Preclosure

- Transfer Car Registration

- Top 10 Banks for Car Loan

- Car Loan Schemes for Government Employees

- Fuel Efficient Sedan Cars

- Automatic Cars for Women

- Chepest Cars in India

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.